Blockbuster (

BBI) shares lost nearly 30% of their value yesterday, as the company suggested that its ability to continue as a going concern remains in doubt. GameStop (

GME) and Blockbuster do share some similarities, leaving investors to wonder if Blockbuster is not just a few years ahead of GameStop in the inevitable fall of both companies. Is GameStop also doomed?

A few years ago, Blockbuster had a seemingly viable business model. Since then, however, the world has passed it by. While the company trudged along as a

bricks and mortar, other companies allowed movie viewers to download/order movies online or order movies on-demand through their cable boxes from the comfort of their homes.

It is not implausible to believe that a similar fate could befall GameStop. It's not a wild leap to assume that in the future, game consoles will allow gamers to browse online catalogues of games directly on their televisions, and purchase and download these games directly, by-passing the distribution network on which GameStop is so reliant.

Though this points to a grim future for GameStop, there are some important differences which make the GameStop / Blockbuster situations rather dissimilar. First of all, to the surprise of many, Blockbuster has never really made money, even when it should have been able to. From 1996 to 2000, when the company should have been raking it in, it lost over $700 million! The ensuing ten years were even worse, as the company rarely had a profitable year, and managed to lose several hundred million dollars in the process.

GameStop, on the other hand, is dealing from a position of financial strength: the company has made over $900 million over the last five years, and carries just $400 million of debt, while holding $300 million of cash. As such, instead of fighting fires and figuring out how to pay debt and expenses,

GameStop can focus on pursuing profitable business opportunities.

GameStop also sells devices that make the software valuable. Without the consoles, and extra hardware in the form of controllers, balance boards, punching gloves, steering wheels, foot pedals and other contraptions, the innovative software is not as interesting. While margins on these items are currently low, as retailers try to make money on the software, these margins may have to rise to entice the retailers to continue to sell them if most of the software is downloaded.

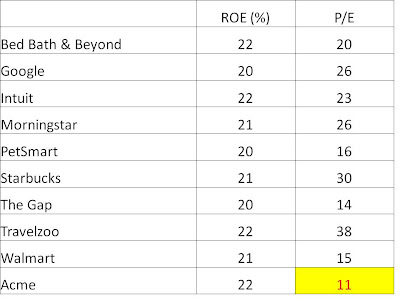

Most importantly of all, however, GameStop is an innovative company. Management has consistently shown an ability to squeeze out profits, even in the face of strong competition from the likes of Wal-Mart and Best Buy. GameStop's successful foray into the used game market, where it essentially created a lucrative niche where no market previously existed, has allowed it to benefit from strong margins from used games as big box retailers have reduced the margins on new software titles. With able management, and dealing from a position of financial strength, with strong cash flow generation, a low debt to equity level, and strong returns on equity, GameStop is in a position to fight to stay around like Blockbuster never could.

But investors have priced the stock as if its death is around the corner. The company's demise, however, is far from a foregone conclusion. With a price to operating cash flow of just over 5 and almost no net debt, GameStop trades at bargain levels. At this price, the downside is priced in; but if the company is able to last a few years longer than expected, investors may find that this

stock idea was worth the investment.

Disclosure: Author has a long position in shares of GME