Frank and I discuss a few stories from around the web that caught our interest. Let us know what you think!

Frank: Saw this neat video on gold the other day.

Saj: I love how it's both a deflation and inflation hedge. Magical!

Frank: Just have faith!

Saj: Of course, ever the contrarian, Warren Buffett doesn't like gold:

You could take all the gold that's ever been mined, and it would fill a cube 67 feet in each direction. For what that's worth at current gold prices, you could buy all -- not some -- all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?

Frank: Of course you want the cube!

Saj: Yeah, you can't store 10 Exxon's in an underground vault!

Frank: And seriously, what are you going to do with $1 trillion in cash at today's highly inflated prices? Give me that in gold and you've got yourself a deal!

Saj: Why don't gold miners just pay their dividends in gold instead of cash? Don't they know their investors are just buying more gold with it anyway?

Frank: The investors still need the paper currency to heat their houses when Armageddon arrives.

Saj: I love how Netflix continues to buy back shares even though its P/E is at 70.

Frank: Great use of corporate cash!

Saj: They would have liked to buy shares of Amazon instead, but Amazon's P/E, at 73, was just too pricey.

Frank: Thank God for relative valuation techniques!

Saj: Yeah, that just saved them from a huge mistake! Phew!

Frank: It looks like the cash-strapped Ontario government is getting into the online gambling business.

The OLG estimates that Ontarians spend approximately $400 million each year in unregulated online gambling — with none of that money entering government coffers through taxation or fees. "In its current form, internet gaming in Ontario does not return proceeds to this province," said Godfrey.

Saj: The "current form" being: you're not allowed to start a gaming company as a private citizen.

Frank: "But we can, cause we're the government!"

Saj: Why stop at gaming?

Frank: Yeah, what about all the cocaine money that leaves Ontario?

Saj: Resulting in no taxes and jobs for the good people of Ontario!

Frank: Or why not just let the private sector do it, and then regulate it?

Saj: They don't like that model. "In other news, the Ontario government is going to set up its own airline."

Frank: "Yeah, we know we *could* have the private sector run airlines and then just regulate them for safety and tax their profits"

Saj: "But we'd rather just profit from a legislated monopoly instead."

Frank: Who ends up paying for the higher costs associated with monopolies? The addicted gamblers of course, whom the government is "protecting" with this legislation.

Friday, December 31, 2010

Thursday, December 30, 2010

Average Income Not Always Relevant

When estimating a company's earning power, it's important to look at its annual earnings over the past business cycle, rather than assume that its current earnings are representative of future earnings. In Security Analysis, Ben Graham and David Dodd discussed the need to smooth out fluctuations in annual earnings, and we have looked at some reasons for why that is the case. Sometimes, however, properties of a company have changed, and current earnings may actually be a better gauge of a company's earnings prospects going forward.

Consider Dover Downs Gaming (DDE), a hotel/casino/track operator in Delaware. In addition to corporate tax rates that are already quite high, the state government has been increasing the company's gaming fees and taxes. The fee changes are not minimal, and are not recorded as taxes, and therefore show up as increased operating expenses. Consider the following statement from the recent 10-Q:

"Gaming expenses increased by $8,066,000, or 6.1%, primarily as a result of the opening of our table game operations and significantly higher gaming taxes and slot machine fees that resulted from legislation passed in May of 2009. The impact of this legislative initiative resulted in an increase in our gaming taxes and slot machine fees of approximately $5,600,000 in the first nine months of 2010."

This $5.6 million for the last three quarters is not a trivial amount. It represents about 3.5% of this period's revenues, and as such results in taking a huge chunk out of the company's profit margin. On an annualized basis, these new fees take a significant bite out of the company's operating earnings of around $40 million per year or so in the last four years, reducing the earnings power of this company significantly.

The new fees had such an impact that the company cancelled plans to expand:

"We had previously completed architectural and engineering work related to a Phase 7 casino expansion that would have included, among other things, a new sports book facility and a parking garage. Given the recent decision by the US Court of Appeals for the Third Circuit to limit the extent of sports wagering in Delaware and the higher gaming tax rates that were recently legislated, we decided not to proceed with this project. During the third quarter of 2009, we wrote off $2,177,000 of capitalized costs related to these expansion projects."

While averaging past earnings do smooth out temporary fluctuations in annual earnings, the investor must still keep an eye out for recent changes to the business that render operating earnings obsolete. Adjustments to averaged earnings that take recent changes into effect will often need to be made to improve their predictability in the determination of a company's earnings power.

Disclosure: None

Consider Dover Downs Gaming (DDE), a hotel/casino/track operator in Delaware. In addition to corporate tax rates that are already quite high, the state government has been increasing the company's gaming fees and taxes. The fee changes are not minimal, and are not recorded as taxes, and therefore show up as increased operating expenses. Consider the following statement from the recent 10-Q:

"Gaming expenses increased by $8,066,000, or 6.1%, primarily as a result of the opening of our table game operations and significantly higher gaming taxes and slot machine fees that resulted from legislation passed in May of 2009. The impact of this legislative initiative resulted in an increase in our gaming taxes and slot machine fees of approximately $5,600,000 in the first nine months of 2010."

This $5.6 million for the last three quarters is not a trivial amount. It represents about 3.5% of this period's revenues, and as such results in taking a huge chunk out of the company's profit margin. On an annualized basis, these new fees take a significant bite out of the company's operating earnings of around $40 million per year or so in the last four years, reducing the earnings power of this company significantly.

The new fees had such an impact that the company cancelled plans to expand:

"We had previously completed architectural and engineering work related to a Phase 7 casino expansion that would have included, among other things, a new sports book facility and a parking garage. Given the recent decision by the US Court of Appeals for the Third Circuit to limit the extent of sports wagering in Delaware and the higher gaming tax rates that were recently legislated, we decided not to proceed with this project. During the third quarter of 2009, we wrote off $2,177,000 of capitalized costs related to these expansion projects."

While averaging past earnings do smooth out temporary fluctuations in annual earnings, the investor must still keep an eye out for recent changes to the business that render operating earnings obsolete. Adjustments to averaged earnings that take recent changes into effect will often need to be made to improve their predictability in the determination of a company's earnings power.

Disclosure: None

Wednesday, December 29, 2010

$100 Give-Away

This isn't a contest, this is what the market is offering you! Phoenix Footwear Group (PXG) wants to go private. In so doing, it needs to shed some shareholders. As such, it plans to conduct a 1-for-200 reverse-split, followed by a 200-for-1 split. In the process, it will pay cash to shareholders who own less than 200 shares.

Phoenix Footwear currently trades at 25 cents per share, but the company will pay out 75 cents per share to shareholders owning less than 200 shares. This means the shareholder has to spend $50 to get a payout of $150, for a profit of $100. A few months ago, we saw Boss Holdings (BSHI) do something very similar.

In so doing, the company hopes to get down to less than 300 shareholders. This would allow the company to cease its registration with the SEC, and therefore save a bunch of annual operating costs. As the company trades for just $2 million, the costs associated with registration are rather onerous.

It should be noted, however, that the shareholders still have to approve this plan. They will vote on it in late January at the annual shareholder meeting. Furthermore, shareholders may have to get their brokers to change the shares from being held in "street name" to their own names in order to participate in the payout. If you plan to participate, you should talk to your broker about how your shares will be treated.

Disclosure: None

Phoenix Footwear currently trades at 25 cents per share, but the company will pay out 75 cents per share to shareholders owning less than 200 shares. This means the shareholder has to spend $50 to get a payout of $150, for a profit of $100. A few months ago, we saw Boss Holdings (BSHI) do something very similar.

In so doing, the company hopes to get down to less than 300 shareholders. This would allow the company to cease its registration with the SEC, and therefore save a bunch of annual operating costs. As the company trades for just $2 million, the costs associated with registration are rather onerous.

It should be noted, however, that the shareholders still have to approve this plan. They will vote on it in late January at the annual shareholder meeting. Furthermore, shareholders may have to get their brokers to change the shares from being held in "street name" to their own names in order to participate in the payout. If you plan to participate, you should talk to your broker about how your shares will be treated.

Disclosure: None

Tuesday, December 28, 2010

Best Buy Overreactions

As a retailer of consumer electronics, Best Buy receives a disproportionate amount of income in the quarter which covers the December period. Consider the following graph, which depicts Best Buy's earnings by quarter and for the full year:

Clearly, the first three quarters play only a small role in determining the success of Best Buy's year. Despite this, the company's stock price fluctuates dramatically based on how well results in these quarters match-up with expectations.

For example, between the months of April and September of this year, the stock price traded between a range of $30 and $49 per share. Did the company's value really change by more than 60%, or is the market merely overreacting to some rather inconsequential quarterly reports?

I would argue the latter. Best Buy is an incredibly stable business, as shown by its return on invested capital levels over the last several years. Furthermore, Best Buy's streak of generating excellent returns continues, as its return on equity (ROE) over the last 12 months is 24%.

But because the market overreacts to quarterly misses, investors are offered great entry points for this stock. Two weeks ago, Best Buy reported operating income that was higher than it was last year, but that missed expectations. As a result, the stock fell dramatically; the company now trades at a P/E of just 8, based on its current market cap and its last 12 months of earnings.

Market overreactions with this stock are rather common. Long-term investors can take advantage of the situation by buying when the stock gets punished to low P/E levels, and selling when positive sentiment returns.

Disclosure: Author has a long position in shares of BBY

Clearly, the first three quarters play only a small role in determining the success of Best Buy's year. Despite this, the company's stock price fluctuates dramatically based on how well results in these quarters match-up with expectations.

For example, between the months of April and September of this year, the stock price traded between a range of $30 and $49 per share. Did the company's value really change by more than 60%, or is the market merely overreacting to some rather inconsequential quarterly reports?

I would argue the latter. Best Buy is an incredibly stable business, as shown by its return on invested capital levels over the last several years. Furthermore, Best Buy's streak of generating excellent returns continues, as its return on equity (ROE) over the last 12 months is 24%.

But because the market overreacts to quarterly misses, investors are offered great entry points for this stock. Two weeks ago, Best Buy reported operating income that was higher than it was last year, but that missed expectations. As a result, the stock fell dramatically; the company now trades at a P/E of just 8, based on its current market cap and its last 12 months of earnings.

Market overreactions with this stock are rather common. Long-term investors can take advantage of the situation by buying when the stock gets punished to low P/E levels, and selling when positive sentiment returns.

Disclosure: Author has a long position in shares of BBY

Monday, December 27, 2010

Buybacks: In Style At The Wrong Time

Compared to dividends, buybacks provide a more tax efficient method of returning cash to shareholders. But any tax benefits may be more than reversed by the exceedingly poor prices at which corporations buy back their own shares.

Previously, we have seen anecdotal evidence of this, as we examined the recent buyback records of Wal-Mart, The Home Depot, Best Buy, Target and Lowe's. The higher the stock price, the more money these firms would pump into buying back shares, which was the exact opposite of what they should have been doing. For a more recent example, look no further than Netflix (NFLX), which trades at a P/E of 70 and yet continues to buy back shares.

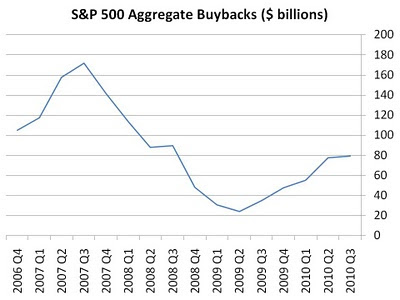

Anecdotal evidence can be misleading, however, and therefore it makes more sense to consider the aggregate market as a whole. The following chart depicts the level of buybacks for the S&P 500 over the last four years:

Note how well this correlates with the overall market. As the market peaked in 2007, firms were furiously buying up shares. As the market fell to its lowest level in March of 2009, companies were too scared to buy back shares. Yet, this is exactly when many companies (those not in debt trouble) should have been active in the market.

Today, companies in the aggregate appear to have regained their appetites for buybacks. But prices have recovered as well, so that even though buyback funds are almost four times higher than they were in the second quarter of 2009, they pack about 40% less punch per dollar. Seeing as how the top tax rate on corporate dividends in the US is 15%, perhaps investors in the aggregate would be better off with dividends over buybacks despite the tax hit.

source: Standard and Poor's

Previously, we have seen anecdotal evidence of this, as we examined the recent buyback records of Wal-Mart, The Home Depot, Best Buy, Target and Lowe's. The higher the stock price, the more money these firms would pump into buying back shares, which was the exact opposite of what they should have been doing. For a more recent example, look no further than Netflix (NFLX), which trades at a P/E of 70 and yet continues to buy back shares.

Anecdotal evidence can be misleading, however, and therefore it makes more sense to consider the aggregate market as a whole. The following chart depicts the level of buybacks for the S&P 500 over the last four years:

Note how well this correlates with the overall market. As the market peaked in 2007, firms were furiously buying up shares. As the market fell to its lowest level in March of 2009, companies were too scared to buy back shares. Yet, this is exactly when many companies (those not in debt trouble) should have been active in the market.

Today, companies in the aggregate appear to have regained their appetites for buybacks. But prices have recovered as well, so that even though buyback funds are almost four times higher than they were in the second quarter of 2009, they pack about 40% less punch per dollar. Seeing as how the top tax rate on corporate dividends in the US is 15%, perhaps investors in the aggregate would be better off with dividends over buybacks despite the tax hit.

source: Standard and Poor's

Sunday, December 26, 2010

The Snowball: Chapters 33, 34, 35 & 36

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.With the market high, Buffett would wind down his fund in 1969 and "retire". In so doing, he returned a lot more money to his partners than they had invested with him over the years. To partners who sought Buffett's opinion on who should manage their funds, Buffett suggested Munger and two others of whom he had high opinions.

Buffett did not convert all of the partnerships' holdings to cash. Partners also received their interest in stock of Berkshire Hathaway and a couple of other companies. Buffett did offer cash or notes in return for these shares, though he added that he would likely continue to buy shares of these companies. To their future economic detriment, many partners sold out.

It is around this time that Buffett came across See's Candy, one of his more famous investments. The offering price for the company was a whopping 5 to 6 times its book value, which almost resulted in Buffett not making the purchase. But Munger, who Buffett brought in as a partner on the deal, absolutely loved the business. The company generated extraordinary returns on capital, and Buffett saw the potential for price increases that would result in even stronger profits. Buffett and Munger were able to buy it at about 11 times earnings, and it has been an extremely profitable purchase for them.

Throughout this period, Buffett also sought media companies. The author remarks that had he not gone into investing, Buffett would likely have gone into journalism, such was his interest in the field. Buffett would buy a couple of small newspaper outfits, but found the top-tier companies too pricey at first. For one of the papers he owned, Buffett would apply his skills to help the paper win a Pulitzer Prize, as the story uncovered a $200 million+ portfolio for a charity that claimed to be in the red. More on that here.

Saturday, December 25, 2010

The Snowball: Chapters 29, 30, 31 & 32

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.Market sentiment was high in the mid-to-late 1960's, and so at times Buffett had difficulty investing. He made a couple of investments in retail which were out of his circle of competence to some extent.

One of them did not work out at all; it was a department store in Baltimore. The problem was that there were three other department stores right nearby, and so they all competed with each other. If one got an elevator, the others would have to as well etc. Buffett saw this as akin to "standing on tip toe at a parade": as soon as one person does it, everyone has to, resulting in everyone being uncomfortable.

Berkshire Hathaway continued to perform poorly through this period. But Buffett did not want to be unpopular, according to the author, so he sometimes made decisions that were in conflict with making money. Instead of shutting them down, he would keep divisions open longer than they should have been.

From his other investments, however, including American Express, Buffett was flush with cash. As such, he was willing to buy National Indemnity for more than he thought it was worth because of the economics of the business. Insurance requires capital to grow, and capital was something Buffett wasn't short of. Insurance also provided a float (money in advance, which only had to be paid back later), which Buffett was an expert at handling.

Finally, Buffett starts to take an interest in something other than investing. He helps finance an anti-war candidate during the Vietnam War, and even volunteers his time as the politician's treasurer. Buffett also shows a preference for something other than collecting money; he announces to his partners that he will make decisions that may reduce returns in return for more enjoyable investing. That is, rather than buy cheap and sell quickly opportunistically, he may keep holding businesses where he likes the nature of the business and the people who run it.

Friday, December 24, 2010

The Snowball: Chapters 25, 26, 27 & 28

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.The author describes one of Buffett's investments in the early 1960's by the name of Dempster Mill. The business was badly managed and the banks were closing in when Buffett bought it on the cheap and put a manager in place (recommended by Munger) to turn things around. The business was saved, but not before the manager had instituted layoffs to cut expenses. The people of the town that relied on the mill were furious that an "outsider" like Buffett was able to profit while many lost their jobs. Buffett was puzzled, wondering if the townspeople knew that he had saved the business. As someone who prefers to please people, Buffett learns from this experience; in the future, he would be better at avoiding the anger of the public.

While Buffett was busy generating returns for his own fund, Charlie Munger was starting a fund of his own. He and Buffett continued to stay in touch, and both learned from each other. Munger did purchase some "Ben Graham"-type stocks, but he preferred quality businesses with competitive advantages. Buffett was influenced by Munger and Philip Fisher (whose book is summarized here) as he transitioned from being a "Ben Graham" investor to one that also looks for companies with intangible assets that generate wealth. This new outlook, in combination with the Salad Oil Scandal that halved the shares of American Express, would lead to Buffett's lucrative purchase of American Express.

As Buffett's fund was an extraordinary success, investors were now flocking to him; he no longer had to pitch. But not everyone can come to terms with the idea of value investing, as per the following quote from Buffett:

“With some, the idea of buying dollar bills for forty cents takes, and with some it doesn’t take. It’s like an inoculation. It’s extraordinary to me. If it doesn’t grab them right away, I find that you can talk to them for years and show them records—you can do everything—and it just doesn’t make any difference. I’ve never seen anyone who became a convert over a ten-year period with this approach. It’s always instant recognition or nothing."

During the early 1960's, Buffett's father also died. Only after his father's death does Warren feel comfortable enough to own up to being a Democrat (Buffett's father was a Republican congressman). Buffett's main reason for defecting was the Democrats' "pro" stance on civil rights.

It is during this period that Buffett also begins to purchase Berkshire Hathaway. It traded at a large discount to its assets and Buffett had no intentions of owning the thing for long, but Buffett felt that the company's manager/controller had reneged on a sale agreement (Buffett had agreed to sell at $11.50, but when it came time to tender the shares, the offer came in at $11.375.) In anger, Buffett decided to buy up more shares (rather than sell) and fire the manager. This would prove to be a mistake, as Buffett reflects later:

“I would have been better off if I’d never heard of Berkshire Hathaway.”

Nevertheless, by 1965, Buffett's net worth is close to $10 million while he manages much more through his investors/partners. Investments are hard to come by, and so Buffett closes the fund to new money.

Thursday, December 23, 2010

Behind The Competitive Advantage

Companies with strong ROIC and strong ROE numbers may have competitive advantages. On the other hand, there could be many reasons for high returns which could trick the investor into believing a competitive advantage is present. Therefore, it's important for the shareholder to identify the competitive advantage before accepting it as true.

Rising (or falling) commodity prices could make companies which sell (or buy) commodities look like they have an advantage. Temporarily strong markets, or temporary weakness in competitors can also have the same effect. These occurrences will result in elevated returns for extended periods, occasionally for several years. Managements for these companies will of course take credit for such uncontrollable but favourable circumstances, and will claim that the abnormally high returns are due to their effectiveness in securing a competitive advantage for the company. Therefore, the shareholder must investigate the situation and apply his own business sense to determine if the advantage is for real.

Unfortunately, there is no formula one can apply to determine if a competitive advantage exists. Investors must use good judgement, conduct diligent research, and educate themselves by reading the examples of successful investments of the past. Competitive advantages come in all shapes and sizes. For example, Cisco Systems, discussed on the site a few weeks ago, may have an advantage due to its high market share, allowing it to spread its R&D spend over more units, resulting in a quality per cost advantage. Apple (AAPL) may have an advantage in its processes that allow it to consistently innovate and design new products for the consumer.

Philip Fisher's book Common Stocks with Uncommon Profits helps guide the investor in thinking about whether a company in question has a competitive advantage. This is a book that Buffett learned from as well, as he transitioned from Ben Graham stocks to companies with competitive advantages. The book is summarized here.

Rising (or falling) commodity prices could make companies which sell (or buy) commodities look like they have an advantage. Temporarily strong markets, or temporary weakness in competitors can also have the same effect. These occurrences will result in elevated returns for extended periods, occasionally for several years. Managements for these companies will of course take credit for such uncontrollable but favourable circumstances, and will claim that the abnormally high returns are due to their effectiveness in securing a competitive advantage for the company. Therefore, the shareholder must investigate the situation and apply his own business sense to determine if the advantage is for real.

Unfortunately, there is no formula one can apply to determine if a competitive advantage exists. Investors must use good judgement, conduct diligent research, and educate themselves by reading the examples of successful investments of the past. Competitive advantages come in all shapes and sizes. For example, Cisco Systems, discussed on the site a few weeks ago, may have an advantage due to its high market share, allowing it to spread its R&D spend over more units, resulting in a quality per cost advantage. Apple (AAPL) may have an advantage in its processes that allow it to consistently innovate and design new products for the consumer.

Philip Fisher's book Common Stocks with Uncommon Profits helps guide the investor in thinking about whether a company in question has a competitive advantage. This is a book that Buffett learned from as well, as he transitioned from Ben Graham stocks to companies with competitive advantages. The book is summarized here.

Wednesday, December 22, 2010

The Fraudulent Small-Cap Universe

Getting second opinions on small-cap stocks in which you are interested isn't easy to do. There is no analyst coverage, and few people following most of the small-caps out there. To that end, I wrote a post a few months ago describing Agoracom as a potentially useful resource for small-cap investors. That turned out to be a mistake.

While the post in question mentioned that Agoracom's "business model derives revenue not from advertising, but from the small cap companies themselves", and that as a result, "it is unlikely you will find much in the way of negative information (about a stock)", the post severely underestimated the extent to which Agoracom was willing to go to push the stocks of its clients.

As it turns out, Agoracom was going way overboard. The Ontario Securities and Exchange Commission alleges that Agoracom's stock message board was mostly full of pump messages from its own employees. Apparently, some employees were required to post at least two messages per day or have their pay docked. These employees wrote messages under more than 670 fake profiles.

It gets worse. Apparently, the company's VP Operations was also monitoring private messages between real posters on the message board, in order to glean information about companies in which he was personally invested.

The bottom-line for small-cap investors is that there isn't a whole lot out there you can trust, including suggestions you get on this site! You have no choice but to be skeptical about anything you read, (especially on anonymous forums!) and to do your own research. In the alternative, you will get taken for a ride.

While the post in question mentioned that Agoracom's "business model derives revenue not from advertising, but from the small cap companies themselves", and that as a result, "it is unlikely you will find much in the way of negative information (about a stock)", the post severely underestimated the extent to which Agoracom was willing to go to push the stocks of its clients.

As it turns out, Agoracom was going way overboard. The Ontario Securities and Exchange Commission alleges that Agoracom's stock message board was mostly full of pump messages from its own employees. Apparently, some employees were required to post at least two messages per day or have their pay docked. These employees wrote messages under more than 670 fake profiles.

It gets worse. Apparently, the company's VP Operations was also monitoring private messages between real posters on the message board, in order to glean information about companies in which he was personally invested.

The bottom-line for small-cap investors is that there isn't a whole lot out there you can trust, including suggestions you get on this site! You have no choice but to be skeptical about anything you read, (especially on anonymous forums!) and to do your own research. In the alternative, you will get taken for a ride.

Tuesday, December 21, 2010

The Competitive Advantage of China MediaExpress

China MediaExpress (CCME) provides television advertising on highway buses in China. The company trades for $525 million, but has earned $92 million in the last four quarters. In addition, the company has $170 million of cash against no debt. This would be an attractive valuation even for a company in decline, but China MediaExpress is in fact growing, as year-over-year revenue and profit growth in its most recent quarter is up 100% and 200% respectively.

Of course, many Chinese companies have a bad name right now because of rampant fraud that has been uncovered with respect to a few of them. But this one has a bit more credibility than the rest. For one thing, its financials are audited by Deloitte, rather than a mom-and-pop accounting firm or one that has had a relatively large number of legal issues in the past. The company also has a number of sophisticated investors, including Starr Investments, which is headed by Hank Greenberg. The company's clients also include reputable names such as Coke, Pepsi and Toyota.

But while the company appears cheap as well as legitimate, there are still some troubling signs. First, the company has a history of diluting its shareholders. Its diluted weighted average shares have nearly doubled in just the last year, from 20 million to 38 million. Furthermore, another 1.5 million warrants were exercised two weeks ago, and another 1.5 million or so remain outstanding, with very low exercise prices ($1/share, while the current share price is $15/share).

The company also has convertible preferred stock outstanding that can be converted into another 3 million common shares. What's most puzzling is that when the company issued the preferred shares in return for $30 million, it already had about $80 million in the bank against no debt. And it still hasn't put that money to work, which has resulted in what appears to be completely needless dilution!

But perhaps the biggest risk to this company comes from the source of its competitive advantage: the government. Until 2012, the company has an agreement with "an entity affiliated with the Ministry of Transport of the People's Republic of China to be the sole strategic alliance partner in the establishment of a nationwide in-vehicle television system that displays copyrighted programs on buses traveling on highways in China."

This agreement appears to have been extremely lucrative for the company, as it generates returns on equity of around 100%! But what happens after 2012? Who knows! The operating circumstances could change dramatically, or maybe not at all. Investors are basically at the mercy of some government official(s).

Until then, this company appears likely to continue to generate returns. But without any agreements beyond 2012, whether shareholders will get back a return on their investment at this price is an open question.

Disclosure: None

Of course, many Chinese companies have a bad name right now because of rampant fraud that has been uncovered with respect to a few of them. But this one has a bit more credibility than the rest. For one thing, its financials are audited by Deloitte, rather than a mom-and-pop accounting firm or one that has had a relatively large number of legal issues in the past. The company also has a number of sophisticated investors, including Starr Investments, which is headed by Hank Greenberg. The company's clients also include reputable names such as Coke, Pepsi and Toyota.

But while the company appears cheap as well as legitimate, there are still some troubling signs. First, the company has a history of diluting its shareholders. Its diluted weighted average shares have nearly doubled in just the last year, from 20 million to 38 million. Furthermore, another 1.5 million warrants were exercised two weeks ago, and another 1.5 million or so remain outstanding, with very low exercise prices ($1/share, while the current share price is $15/share).

The company also has convertible preferred stock outstanding that can be converted into another 3 million common shares. What's most puzzling is that when the company issued the preferred shares in return for $30 million, it already had about $80 million in the bank against no debt. And it still hasn't put that money to work, which has resulted in what appears to be completely needless dilution!

But perhaps the biggest risk to this company comes from the source of its competitive advantage: the government. Until 2012, the company has an agreement with "an entity affiliated with the Ministry of Transport of the People's Republic of China to be the sole strategic alliance partner in the establishment of a nationwide in-vehicle television system that displays copyrighted programs on buses traveling on highways in China."

This agreement appears to have been extremely lucrative for the company, as it generates returns on equity of around 100%! But what happens after 2012? Who knows! The operating circumstances could change dramatically, or maybe not at all. Investors are basically at the mercy of some government official(s).

Until then, this company appears likely to continue to generate returns. But without any agreements beyond 2012, whether shareholders will get back a return on their investment at this price is an open question.

Disclosure: None

Monday, December 20, 2010

Argan Inc: Deceptive Cash Balances

Value investors love companies with large cash balances. These companies are the least likely to flirt with financial trouble and are in a position to pay dividends and/or buy back shares. As such, when valuing companies, investors will often add a company's cash balance to the company's earnings power valuation in order to determine the company's intrinsic value. Sometimes, however, this practice can get the investor in trouble.

Consider Argan (AGX), a company primarily engaged in the production of a range of power plants. The company trades for $125 million, and generates about $10 million per year in operating income. This may not look like a steal, until one takes into account that Argan also has $76 million in cash. As such, it looks very attractive at first glance!

Unfortunately, however, the company actually needs the cash. As such, it does not appear as though that cash will be distributed to shareholders, as the nature of Argan's business requires that it maintain a ton of cash on hand, for a couple of reasons.

First, the company is paid by customers in advance for some of its construction work. But because the timing of future sales is uncertain (the company's backlog is largely composed of just 2 or 3 projects at a time), that cash is required to pay for the work the company has been contracted to complete. Dell (DELL) is an example of another company that is paid before it has to deliver its products, but Dell can more safely distribute that cash as the stream of future orders constantly replenishes its cash balance. Argan's situation is more uncertain, as it cannot distribute cash on the expectation that it will win future production contracts that replenish reserves.

In other cases, the company must perform work before it is paid. It is not uncommon to see the company's accounts receivable balance jump by tens of millions of dollars over the course of a single quarter. This again requires the company to hold ample cash reserves in order to fund construction until such time as the customer is obligated to pay.

Management's actions are consistent with the idea that the company needs strong cash reserves to operate successfully. In 2008, despite a cash balance of $70 million, the company raised $25 million of cash in a private placement. Since then, the company continues to hoard cash, having not paid a dividend or bought back shares.

Investors interested in valuing this company should therefore consider the company's cash balance as part of its operating assets, and not as excess cash. For those interested in another example of this type of situation, this is an issue that has come up before with another company.

Disclosure: None

Consider Argan (AGX), a company primarily engaged in the production of a range of power plants. The company trades for $125 million, and generates about $10 million per year in operating income. This may not look like a steal, until one takes into account that Argan also has $76 million in cash. As such, it looks very attractive at first glance!

Unfortunately, however, the company actually needs the cash. As such, it does not appear as though that cash will be distributed to shareholders, as the nature of Argan's business requires that it maintain a ton of cash on hand, for a couple of reasons.

First, the company is paid by customers in advance for some of its construction work. But because the timing of future sales is uncertain (the company's backlog is largely composed of just 2 or 3 projects at a time), that cash is required to pay for the work the company has been contracted to complete. Dell (DELL) is an example of another company that is paid before it has to deliver its products, but Dell can more safely distribute that cash as the stream of future orders constantly replenishes its cash balance. Argan's situation is more uncertain, as it cannot distribute cash on the expectation that it will win future production contracts that replenish reserves.

In other cases, the company must perform work before it is paid. It is not uncommon to see the company's accounts receivable balance jump by tens of millions of dollars over the course of a single quarter. This again requires the company to hold ample cash reserves in order to fund construction until such time as the customer is obligated to pay.

Management's actions are consistent with the idea that the company needs strong cash reserves to operate successfully. In 2008, despite a cash balance of $70 million, the company raised $25 million of cash in a private placement. Since then, the company continues to hoard cash, having not paid a dividend or bought back shares.

Investors interested in valuing this company should therefore consider the company's cash balance as part of its operating assets, and not as excess cash. For those interested in another example of this type of situation, this is an issue that has come up before with another company.

Disclosure: None

Sunday, December 19, 2010

The Snowball: Chapters 21, 22, 23 & 24

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.Buffett became a star at Graham-Newman. Eventually, Ben Graham's other hobbies took over his time; he was ready to retire. (Buffett was able to tell that all was not right when Graham made some questionable portfolio decisions. For example, Graham made a curious investment in the large, well-followed, fairly-valued AT&T, which was a very abnormal choice for the firm.) Buffett was offered a partnership position at the firm, but Buffett had only been there to work with Graham; without Graham there, Buffett would prefer to strike out on his own. As a result, Graham-Newman was shut down.

The author then details the formations of all of the Buffett partnerships of the 1950s and early 1960s. As Buffett's results were strong, he was drawing more and more capital to his funds. But at this point in his career, he always had more ideas/opportunities for investment than he had funds. So when he wasn't studying potential or actual investments, he was out raising money. This left him little family time for his wife and now three children, according to the author.

Most of Buffett's investments were cigar-butt type companies: companies with not a lot of potential (maybe one last puff of smoke left in them) but trading at bargain prices. But then Buffett met Charlie Munger through one of his partners/investors. Buffett and Munger hit it off right away, and ended up speaking by phone several days a week, sometimes for hours at a time.

Though Buffett's net worth grew substantially during this period, there were many who felt he was running a ponzi scheme. People were wary of how successful he had become. But those who knew him continued to invest because they believed him to be honest. They would be rewarded with stellar returns.

Saturday, December 18, 2010

The Snowball: Chapters 17, 18, 19 & 20

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.Buffett finally has the honour of meeting Ben Graham, which was a huge thrill. Graham was an avid reader, and often preferred the company of books to people. As such, it took a lot of persistence on the part of Buffett to get to know Graham outside of his classes and seminars. Buffett was the only student to achieve an A+ in Graham's class, but that wasn't good enough to land a job at Graham-Newman - yet. Graham turned Buffett down because at the time he would only hire Jews, due to the antisemitism he saw prevalent at other firms, even though Buffett offered to work for free.

Buffett returned to Omaha and instead put his persistence to work towards Susan Thompson, who would end up being his wife. Susan wasn't interested at first, preferring the company of a man her father despised because of his Russian-Jewish heritage. But Buffett spent a lot of time with her family, and in the end his persistence won out.

During this time, Buffett and a partner purchased a gas station, but even though they spent time working there themselves, they could not beat the Texaco station from across the street. It was here that Buffett learnt the value of customer loyalty, as no matter what they did they could not capture customers from the popular owner of the gas bar just a few feet away.

Buffett also spent some time as a broker. But he had problems with the business, due to the conflicts of interest between brokers and clients. Brokers made money off of transactions, whereas Buffett would want to recommend long-term stocks to his clients. He would sell them GEICO and advise them to hold it for twenty years, but it would do nothing for his broker business. He was uncomfortable with the conflicts, and preferred a line of business where he could invest with, rather than against, his clients.

Finally, he gets accepted at Graham-Newman. Buffett moves his family (which now includes a daughter, Susie, and another one on the way) to New York and begins working for Benjamin Graham.

Friday, December 17, 2010

The Negative Emotional Response

As this site has grown in reach over the last couple of years, the amount of reader feedback I have received has accelerated. Unquestionably, the articles that generate the most feedback are those related to particular securities (as opposed to a general article on investor behaviour...like this one). However, while the majority of sites stick to writing about stocks on which they are bullish, I also tend to write about stocks in which I'm not interested, in order to discuss the reasons that add to an investment's risk or subtract from its return. As a result, I've been in a position to observe some interesting reader behaviour.

If someone does not own a stock, and they come across a positive article about it, it doesn't seem to bother them much. I can tell because I have never received hate mail over this! On the other hand, if someone does own a stock, and they come across a negative article about it, they seem to take it personally! This results in my receiving racial slurs, demands for public apologies, and threats that I will be reported to the SEC.

But for everyone who actually initiates a personal attack, there are likely many others who managed to overcome the strong emotional reaction that they felt. Nevertheless, their decision-making ability with respect to this particular security may still have become marred with an emotional bias. I must admit that when I read a negative article about a stock on which I am bullish, I too feel a twinge of anger at the author (though this tendency has definitely dissipated over time as I have gained more experience). By recognizing this tendency, however, investors can take conscious steps to force themselves to have an open mind and to objectively consider the author's points. By doing so, investors can avoid some of the psychological investor pitfalls we've previously discussed.

There are a vast number of factors, many of which are quite subjective, that go into a decision to purchase a particular stock. As such, it follows that even people with similar investment philosophies will disagree on whether a particular security makes for a good investment. And that's okay: investors who turn out to be correct about one particular security will not necessarily be right about others. In the meantime, we can't tell who's right; all an investor can do is try to learn and thereby improve his "batting average", as Warren Buffett likes to call it. Key to this is overcoming the personal feelings involved in objective discussions of relevant securities.

If someone does not own a stock, and they come across a positive article about it, it doesn't seem to bother them much. I can tell because I have never received hate mail over this! On the other hand, if someone does own a stock, and they come across a negative article about it, they seem to take it personally! This results in my receiving racial slurs, demands for public apologies, and threats that I will be reported to the SEC.

But for everyone who actually initiates a personal attack, there are likely many others who managed to overcome the strong emotional reaction that they felt. Nevertheless, their decision-making ability with respect to this particular security may still have become marred with an emotional bias. I must admit that when I read a negative article about a stock on which I am bullish, I too feel a twinge of anger at the author (though this tendency has definitely dissipated over time as I have gained more experience). By recognizing this tendency, however, investors can take conscious steps to force themselves to have an open mind and to objectively consider the author's points. By doing so, investors can avoid some of the psychological investor pitfalls we've previously discussed.

There are a vast number of factors, many of which are quite subjective, that go into a decision to purchase a particular stock. As such, it follows that even people with similar investment philosophies will disagree on whether a particular security makes for a good investment. And that's okay: investors who turn out to be correct about one particular security will not necessarily be right about others. In the meantime, we can't tell who's right; all an investor can do is try to learn and thereby improve his "batting average", as Warren Buffett likes to call it. Key to this is overcoming the personal feelings involved in objective discussions of relevant securities.

Thursday, December 16, 2010

Stock Idea Sources

One of the most common questions I receive from readers is regarding the source of my stock ideas. I seem to always have a heap of potential value stocks on my to-do list, so perhaps I take it for granted that I come across so many ideas worthy of further study. So on the advice of reader and commenter John P, this post is dedicated to describing and discussing my stock idea sources.

There are three main categories from which I derive my stock ideas. The most obvious category is that of the stock screener. Using one of these, the investor can cherry-pick stocks with characteristics that are conducive to his style. Value investors would likely filter for things like low P/E, low P/B and net current assets, either separately or even all at once! The stock screener at Google Finance is intuitive and flexible, but my favourite screener is at robotdough.com (warning: I don't think you can use it without signing up), where one can select for a whole slew of very specific financial statement data. I am also a user of Joel Greenblatt's screener at magicformulainvesting.com (again, I believe you have to register to use it), which employs a method of screening that is the topic of his book which is summarized here.

The second category of sources I use to identify potential value stocks is related to the investor sentiment towards a stock. When investors are downright pessimistic on a stock, it will often show up on one or more contrarian indicators. Examples of such indicators which I scan for potential stock ideas include 52-week low lists, analyst downgrade news, and lists showing the stocks with biggest percentage drops for the day/week/month etc.

Screeners and contrarian indicators are useful ways to identify potential value plays worthy of further study, but by far the largest source of my potential stock ideas is the third and most important category: other value investors. There are a number of different channels from which one can glean ideas from like-minded investors.

For example, one can follow the purchases and sales of value investors who have their own funds. In this post, we discussed how an investor can track the investments of one rather famous value investor.

There are also a number of value bloggers (much like myself) posting a number of value ideas online. If you're looking to find other value bloggers, this is a good place to start. Furthermore, many value investors post and discuss value stock ideas on twitter. By following these individuals, you will get a great many ideas. (If you're new to twitter, you can start by signing up, following me, and then seeing everyone I follow and subsequently following those that you wish to follow).

In addition, some of the best stock ideas I've received have come from you, the reader. I receive e-mails and comments with stock ideas all the time. (To see these comments when I do, you can subscribe to the comments on this site by clicking here and the articles by clicking here.)

Sometimes, a stock will show up in more than one of the above categories at the same time. In cases like that, I may move them to the front of my to-do list! (For example, the most recent member of the Stock Ideas page, Aeropostale, had already been listed on the Magic Formula site when it suffered one of the largest percentage declines on the market after it released its latest results.)

Did I miss an area which you feel is a great source for ideas? Feel free to add to this list in the comments section. I will refer to this page when I am asked this question again.

There are three main categories from which I derive my stock ideas. The most obvious category is that of the stock screener. Using one of these, the investor can cherry-pick stocks with characteristics that are conducive to his style. Value investors would likely filter for things like low P/E, low P/B and net current assets, either separately or even all at once! The stock screener at Google Finance is intuitive and flexible, but my favourite screener is at robotdough.com (warning: I don't think you can use it without signing up), where one can select for a whole slew of very specific financial statement data. I am also a user of Joel Greenblatt's screener at magicformulainvesting.com (again, I believe you have to register to use it), which employs a method of screening that is the topic of his book which is summarized here.

The second category of sources I use to identify potential value stocks is related to the investor sentiment towards a stock. When investors are downright pessimistic on a stock, it will often show up on one or more contrarian indicators. Examples of such indicators which I scan for potential stock ideas include 52-week low lists, analyst downgrade news, and lists showing the stocks with biggest percentage drops for the day/week/month etc.

Screeners and contrarian indicators are useful ways to identify potential value plays worthy of further study, but by far the largest source of my potential stock ideas is the third and most important category: other value investors. There are a number of different channels from which one can glean ideas from like-minded investors.

For example, one can follow the purchases and sales of value investors who have their own funds. In this post, we discussed how an investor can track the investments of one rather famous value investor.

There are also a number of value bloggers (much like myself) posting a number of value ideas online. If you're looking to find other value bloggers, this is a good place to start. Furthermore, many value investors post and discuss value stock ideas on twitter. By following these individuals, you will get a great many ideas. (If you're new to twitter, you can start by signing up, following me, and then seeing everyone I follow and subsequently following those that you wish to follow).

In addition, some of the best stock ideas I've received have come from you, the reader. I receive e-mails and comments with stock ideas all the time. (To see these comments when I do, you can subscribe to the comments on this site by clicking here and the articles by clicking here.)

Sometimes, a stock will show up in more than one of the above categories at the same time. In cases like that, I may move them to the front of my to-do list! (For example, the most recent member of the Stock Ideas page, Aeropostale, had already been listed on the Magic Formula site when it suffered one of the largest percentage declines on the market after it released its latest results.)

Did I miss an area which you feel is a great source for ideas? Feel free to add to this list in the comments section. I will refer to this page when I am asked this question again.

Wednesday, December 15, 2010

Analyst Advice

Every quarter, public companies are required to release their latest financial results. Along with their results, they hold conference calls and accept questions from the public. As we've discussed before, it's important for investors to listen to these calls to understand the challenges the company faces. Usually, analysts ask management about revenue outlooks for various products, margin expectations, overall strategy and other pertinent questions. Sometimes, however, analysts will feel the need to offer some "free" advice to management.

On a conference call for Build-A-Bear (BBW) two years ago when the stock price was near its lowest, here's what Mike Smith of Kansas City Capital had to say when prompted for his question:

"Well, one comment first before I ask a question. I would suggest you don’t buy any stock back because [insert fearful outlook here]"

His opinion is one which was rampant throughout a finance industry that was gripped with fear. At a time when value investors were buying, stock analysts were against buying back shares at the cheapest prices in over a decade. (Of course, the value of analysts is not so clear when you consider their ratings of Lehman Brothers the day before it went down).

Of course, when valuations are already high is when companies tend to buy back their stock, with wholehearted support from analysts. Consider the magnitude of the buybacks that took place three years ago when the market was at its peak. Needless to say, that was not the best use of shareholder capital. On the other hand, Build-A-Bear's stock price has doubled from when this analyst gave his unsolicited advice.

I don't necessarily know that BBW should have been buying back stock at that particular point in time, but that option should most certainly not be automatically discarded; if management sees a certain level of cash flow that more than covers the company's fixed obligations, buybacks at cheap prices may very well be in order, particularly for a company with a lot of cash on hand. Here's what BBW's founder, chairman and CEO had to say on the matter:

"We have to look at it week by week and we do. And I think that if there’s opportunities that present themselves because we can see that the cash is in excess of what we thought would need to operate our business in a normal basis. And we’re also trying to look and forecast into 2009 and how the economic issues will affect us there."

Free advice is worth its price!

Disclosure: None

On a conference call for Build-A-Bear (BBW) two years ago when the stock price was near its lowest, here's what Mike Smith of Kansas City Capital had to say when prompted for his question:

"Well, one comment first before I ask a question. I would suggest you don’t buy any stock back because [insert fearful outlook here]"

His opinion is one which was rampant throughout a finance industry that was gripped with fear. At a time when value investors were buying, stock analysts were against buying back shares at the cheapest prices in over a decade. (Of course, the value of analysts is not so clear when you consider their ratings of Lehman Brothers the day before it went down).

Of course, when valuations are already high is when companies tend to buy back their stock, with wholehearted support from analysts. Consider the magnitude of the buybacks that took place three years ago when the market was at its peak. Needless to say, that was not the best use of shareholder capital. On the other hand, Build-A-Bear's stock price has doubled from when this analyst gave his unsolicited advice.

I don't necessarily know that BBW should have been buying back stock at that particular point in time, but that option should most certainly not be automatically discarded; if management sees a certain level of cash flow that more than covers the company's fixed obligations, buybacks at cheap prices may very well be in order, particularly for a company with a lot of cash on hand. Here's what BBW's founder, chairman and CEO had to say on the matter:

"We have to look at it week by week and we do. And I think that if there’s opportunities that present themselves because we can see that the cash is in excess of what we thought would need to operate our business in a normal basis. And we’re also trying to look and forecast into 2009 and how the economic issues will affect us there."

Free advice is worth its price!

Disclosure: None

Tuesday, December 14, 2010

SuperValu: Leveraged Buy-Out For Retail Investors

Have you ever wanted to participate in a leveraged buyout (LBO), but lacked the capital, the management expertise, and the lenders willing to finance most of the purchase? You are in luck! SuperValu (SVU), at today's prices, has almost all of the characteristics of an LBO without actually being an LBO. This is an important distinction, because it gives you the opportunity to participate.

LBO's are best done on companies with consistent cash flows, as these cash flows will be relied upon to reduce the debt used to finance the purchase. SuperValu has got the cash flow consistency. Demand for groceries does not go away no matter what goes on with the economy, and as a diversified retail grocery chain (operating under a number of banners including Acme, Albertsons, Bristol Farms, Cub Foods, Farm Fresh, Hornbacher’s, Jewel-Osco, Lucky, Save-A-Lot, Shaw’s, Shop ’n Save, Shoppers Food & Pharmacy and Star Market), SuperValu has generated positive operating margins year after year with little fluctuation. (The red ink on the income statements reflects Goodwill write-downs from past purchases, and do not affect the company's cash flows.)

LBO's are also characterized by having a strong, motivated management team to increase efficiency. To that end, SuperValu hired away Wal-Mart's CEO of the Americas to serve as the company's chief executive. Since his hiring in 2009, the CEO has applied cash flows to pay down debt: in the last three quarters, the company has generated about $1.4 billion in cash from operations, and applied over $1 billion of that to debt repayment. He has also implemented initiatives aimed at improving operations, including centralizing marketing, reducing SKUs, and reducing prices. Eighty-six percent of his pay is performance based.

LBO's are also characterized by large debt obligations relative to equity. This is what allows for the large upside for equity owners (profits beyond what is needed to pay off debt accrues to a small amount of equity, resulting in the potential for big returns), but it also represents the biggest risk to the enterprise. Again, SuperValu fits right into the LBO pattern: the company has total debt of $7.1 billion, compared to a market cap of just $1.8 billion.

To understand the threat to SuperValu posed by the company's debt, it's important to consider how well the company is able to service its debt obligations. Interest coverage looks okay, as EBIT/interest is around 2, and EBITDA/interest is around 4. But principal repayments appear to be more of a threat, as some of the company's long-term debt is coming due quite soon. The following chart depicts the company's debt obligations over the next several calendar years:

The company only generates operating income of just over $1 billion, so the repayments due in 2011 loom quite large. Additionally, the company has a total of around $1 billion of capital leases due over the next several years which are not included in the chart above. But store refreshes are essential in retail, and this debt repayment schedule does not allow for much re-investment in the business, which is crucial to sustaining cash flow in the future. The company is also experiencing success with its Save-A-Lot banner, and therefore plans to spend capital to open a number of such stores in the coming year.

So how can the company meet its obligations and run the business successfully? Using its bank revolver. The company has a revolving line of credit expiring in 2015 under which it still has $1.7 billion available. As such, whatever it cannot pay off in 2011, it can borrow from the revolver. Adjusting the above chart for this revolver makes the debt schedule look as follows:

This gives the company a lot of breathing room in the near term. But it doesn't mean the company's debt is not a threat. What it does do, however, is allow the company to make the capital expenditures it needs to improve the business. Capex not required by the business (which appears to be most of the company's operating cash flow, judging from management's actions) can still go towards paying off debt.

Finally, the company has also been selling under-performing assets in order to generate cash. This helps both accelerate debt payments and make the company more profitable.

The price of the entire Supervalu enterprise (debt + equity) is around $9 billion, against earnings before interest, taxes and non-cash writedowns of about $1.1 billion, for an EV/EBIT ratio of about 8. Since SuperValu has both the breathing room and the cash flows to make the debt repayments and capital expenditures it needs to, the company should see an increase in the market value of its shares even if its enterprise value were to fall.

Disclosure: None

* The graph is an approximation based on the company's disclosures in its latest 10-Q.

LBO's are best done on companies with consistent cash flows, as these cash flows will be relied upon to reduce the debt used to finance the purchase. SuperValu has got the cash flow consistency. Demand for groceries does not go away no matter what goes on with the economy, and as a diversified retail grocery chain (operating under a number of banners including Acme, Albertsons, Bristol Farms, Cub Foods, Farm Fresh, Hornbacher’s, Jewel-Osco, Lucky, Save-A-Lot, Shaw’s, Shop ’n Save, Shoppers Food & Pharmacy and Star Market), SuperValu has generated positive operating margins year after year with little fluctuation. (The red ink on the income statements reflects Goodwill write-downs from past purchases, and do not affect the company's cash flows.)

LBO's are also characterized by having a strong, motivated management team to increase efficiency. To that end, SuperValu hired away Wal-Mart's CEO of the Americas to serve as the company's chief executive. Since his hiring in 2009, the CEO has applied cash flows to pay down debt: in the last three quarters, the company has generated about $1.4 billion in cash from operations, and applied over $1 billion of that to debt repayment. He has also implemented initiatives aimed at improving operations, including centralizing marketing, reducing SKUs, and reducing prices. Eighty-six percent of his pay is performance based.

LBO's are also characterized by large debt obligations relative to equity. This is what allows for the large upside for equity owners (profits beyond what is needed to pay off debt accrues to a small amount of equity, resulting in the potential for big returns), but it also represents the biggest risk to the enterprise. Again, SuperValu fits right into the LBO pattern: the company has total debt of $7.1 billion, compared to a market cap of just $1.8 billion.

To understand the threat to SuperValu posed by the company's debt, it's important to consider how well the company is able to service its debt obligations. Interest coverage looks okay, as EBIT/interest is around 2, and EBITDA/interest is around 4. But principal repayments appear to be more of a threat, as some of the company's long-term debt is coming due quite soon. The following chart depicts the company's debt obligations over the next several calendar years:

The company only generates operating income of just over $1 billion, so the repayments due in 2011 loom quite large. Additionally, the company has a total of around $1 billion of capital leases due over the next several years which are not included in the chart above. But store refreshes are essential in retail, and this debt repayment schedule does not allow for much re-investment in the business, which is crucial to sustaining cash flow in the future. The company is also experiencing success with its Save-A-Lot banner, and therefore plans to spend capital to open a number of such stores in the coming year.

So how can the company meet its obligations and run the business successfully? Using its bank revolver. The company has a revolving line of credit expiring in 2015 under which it still has $1.7 billion available. As such, whatever it cannot pay off in 2011, it can borrow from the revolver. Adjusting the above chart for this revolver makes the debt schedule look as follows:

This gives the company a lot of breathing room in the near term. But it doesn't mean the company's debt is not a threat. What it does do, however, is allow the company to make the capital expenditures it needs to improve the business. Capex not required by the business (which appears to be most of the company's operating cash flow, judging from management's actions) can still go towards paying off debt.

Finally, the company has also been selling under-performing assets in order to generate cash. This helps both accelerate debt payments and make the company more profitable.

The price of the entire Supervalu enterprise (debt + equity) is around $9 billion, against earnings before interest, taxes and non-cash writedowns of about $1.1 billion, for an EV/EBIT ratio of about 8. Since SuperValu has both the breathing room and the cash flows to make the debt repayments and capital expenditures it needs to, the company should see an increase in the market value of its shares even if its enterprise value were to fall.

Disclosure: None

* The graph is an approximation based on the company's disclosures in its latest 10-Q.

Monday, December 13, 2010

A Dispute As To Whether It Exists

Some incredible events have taken place recently with respect to a company by the name of China Education Alliance (CEU), a provider of education and training in China. The company was discussed on this site three months ago in an article titled "Too Good To Be True?" because of the potential for fraud. Recently, allegations of fraud have spread, and the company was forced to respond with an emergency conference call to assert that its operations are indeed real!

The allegations started to heat up about two weeks ago when a firm by the name of Kerrisdale Capital released a report detailing their investigation of the company. Kerrisdale uploaded several videos demonstrating problems with the company's payment system and online offerings. Furthermore, Kerrisdale sent Chinese-speaking investigators to the company's main training center in Harbin, China. Apparently, they found that the company's main training center was devoid of personnel, furniture and any other evidence that any operations exist, as shown in the following video:

Following the release of Kerrisdale's report, shares of CEU fell some 40%. But a few days later, the stock had already recovered most of those losses as the company offered a few releases to help quell shareholder concerns. To bolster investor confidence, the company also scheduled an impromptu conference call to directly answer investor questions that could be e-mailed in advance.

Unfortunately for the company, it appears the conference call did little to assuage investor fears, as the stock closed down 30% following the call. The company did answer a number of questions, but offered little in the way of proof. For example, to explain why the company's training center was empty (as shown in the video above), the CFO simply stated that the center had been undergoing remodeling at the time of the investigation.

And then, a few days later, shares once again recovered to a large extent, as the company announced a share buyback program. Perhaps this bolstered investor confidence that the company's cash holdings actually exist!

Some heavy bets (both short and long) have likely been placed on this company. Value investors should stay away (unless, of course, they have uncovered some evidence that has convinced them as to whether the company's operations are real or not) as downside risks are high no matter which side of the bet one is on. Only one side can be right, while the other side will get demolished. It will be interesting to see how this situation unfolds.

Disclosure: None

The allegations started to heat up about two weeks ago when a firm by the name of Kerrisdale Capital released a report detailing their investigation of the company. Kerrisdale uploaded several videos demonstrating problems with the company's payment system and online offerings. Furthermore, Kerrisdale sent Chinese-speaking investigators to the company's main training center in Harbin, China. Apparently, they found that the company's main training center was devoid of personnel, furniture and any other evidence that any operations exist, as shown in the following video:

Following the release of Kerrisdale's report, shares of CEU fell some 40%. But a few days later, the stock had already recovered most of those losses as the company offered a few releases to help quell shareholder concerns. To bolster investor confidence, the company also scheduled an impromptu conference call to directly answer investor questions that could be e-mailed in advance.

Unfortunately for the company, it appears the conference call did little to assuage investor fears, as the stock closed down 30% following the call. The company did answer a number of questions, but offered little in the way of proof. For example, to explain why the company's training center was empty (as shown in the video above), the CFO simply stated that the center had been undergoing remodeling at the time of the investigation.

And then, a few days later, shares once again recovered to a large extent, as the company announced a share buyback program. Perhaps this bolstered investor confidence that the company's cash holdings actually exist!

Some heavy bets (both short and long) have likely been placed on this company. Value investors should stay away (unless, of course, they have uncovered some evidence that has convinced them as to whether the company's operations are real or not) as downside risks are high no matter which side of the bet one is on. Only one side can be right, while the other side will get demolished. It will be interesting to see how this situation unfolds.

Disclosure: None

Sunday, December 12, 2010

The Snowball: Chapters 13, 14, 15 & 16

Warren Buffett chose Alice Schroeder to be his biographer, granting her access to his personal life like no outsider has ever been granted. In The Snowball, she is rather frank and is not always complimentary of the investing legend, which has apparently led to a rift between the two. Here follows a summary of the book.