Brandes starts by defining value investing as finding solid companies with measurable value and buying them when the stock price is significantly lower than their real worth. Brandes quotes Benjamin Graham who distilled down investing into the three words, margin of safety. The margin of safety is the difference between a company's stock price and the value of the underlying business of that company, sometimes referred to as its intrinsic value.

He offers a simple example to illustrate what value investing is. Consider going to a department store in the winter time and going to the remote corner where a clearance rack has swimsuits, tank tops and straw hats selling for pennies on the dollar. If you buy from that rack, you are a value investor.

Brandes clearly states that value investing does not mean investing in dying industries or buying companies that "makes things that rust". On the contrary, Brandes has invested in companies all over the world in many different sectors including technology and pharmaceuticals. His goal is to find the opportunities with the largest margin of safety. A larger margin of safety provides more protection of capital and better return potential.

Brandes does not see growth investing and value investing as incompatible concepts, as long as growth investing is based on fundamental analysis and does not involve speculation. Graham defined speculation as any operation not including a thorough analysis, safety of principal and an adequate return. He extends Graham's definition of speculation to include buying a stock without the intention of holding it for less than 3-5 years and any purchase based on anticipated market movement or forecasting. Brandes does warn that many growth stock prices have already built in lofty future company expectations and don't offer an adequate margin of safety to warrant their purchase.

Value investors need to have long term thinking and not be concerned with stock prices, unless they are low enough to warrant a buy. Value investors need to be very patient and very disciplined because people's fear and greed swings stock prices from one extreme to another. Dramatic price volatility can test value investors resolve and for that reason it's best to ignore prices almost entirely. Focus on the underlying business value which does not change all that often, especially when compared to frequently changing stock prices.

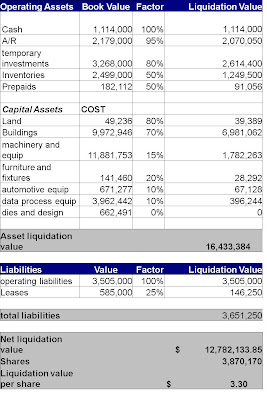

Since the current stock price is $1.64 per share and the calculated liquidation value is $3.30 per share, the market is offering the stock at a 50% discount to its current liquidation value!

Since the current stock price is $1.64 per share and the calculated liquidation value is $3.30 per share, the market is offering the stock at a 50% discount to its current liquidation value!