Karsan Value Funds (KVF) is a value-oriented fund, as described here. Due to securities regulations, the fund is not open to the public at this time. Should that change in the future, there will be an announcement on this site.

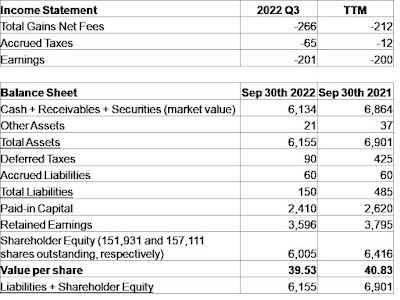

For the third quarter ended September 30th, 2022, KVF lost $1.32 per share, reducing the value of each share to $39.53. This pre-tax loss of 4% was within the range of the 5% loss of the S&P 500 and the 2% losses of the Russell 2000 and S&P/TSX indices over the period.

One cause of this quarter's poor performance was a major loss in the share price of Polished (formerly Goedeker). In August, the company announced that it "has commenced an internal investigation regarding certain allegations made by certain former employees related to the Company’s business operations" and since then it has provided no additional information despite the urging of shareholder groups.

One of KVF's principles is to minimize risk of loss. Continued investment in Polished no longer passes that qualification, and therefore its shares were sold. When losses to a holding occur, it's human nature to roll the dice and pray that the holding eventually returns to its original cost basis, but that's no way to invest. When red flags emerge that would cause one not to buy a given security (as is the case here), the right decision is to sell despite the fact that the loss is now realized.

Other stocks which experienced negative changes in business condition and therefore were sold from the portfolio were Credit Suisse and Hallmark Financial, as discussed here.

Mitigating these losses were gains in the shares of PDRX, MFBP, TNK, LPG and SSY. KVF no longer owns shares of these companies, and the cash generated from these sales was deployed into other investments that are deemed to be more attractive.

It's a buyers market for a lot of stocks. KVF remains fully invested as there are more opportunities right now than there is cash to deploy!

Changes in currency lowered returns by 11 cents per share.

KVF's income statement and balance sheet are included below (click to enlarge). Note that securities are marked to market value, and amounts are in thousands of $CAD:

No comments:

Post a Comment